How Ria Money Transfer reduced investigation time for complex cases by 80%

Ria Money Transfer is a major international money remittance company with in-person or online services available in over 165 countries around the world. Like other organizations in the financial services sector, they are under constant pressure from regulators to prevent fraud and money laundering from occurring via their services.

Their business model comes with several inherent risks. Ria must monitor millions of transactions flowing internationally. And international money transfer is often a target of bad actors looking to launder dirty money. On top of this, they must monitor agents, their first line of defense, who may fall under the pressure of criminal organizations in some areas.

Meeting high regulatory expectations

Several years ago, Ria Money Transfer had a decisive meeting with the Dutch regulator. The regulator pointed out that the money transfer company should enhance its capabilities to identify unusual networks in their investigations. At the time, Ria’s investigation teams were doing link analysis using Excel for their post-transaction analysis. Examining the relationships between senders and recipients in this way was cumbersome and time consuming—and it was leaving them with many blind spots.

Ria needed a better investigative solution to satisfy the regulator’s requirements for criminal network identification. They also wanted to make sure they were getting the full picture of fraud and money laundering networks, and that they could identify all victims in fraud cases.

To fulfill these objectives, Ria’s investigation team decided to use graph technology and began using graph visualization and analytics tools in their investigations, starting with their team in Europe.

Modernizing RIA’s AML practice with graph technology

In 2017, Ria Money Transfer turned to Linkurious Enterprise investigation software combined with Neo4j graph database to strengthen their fraud and anti-money laundering (AML) investigative capabilities. In the years since they have continuously improved their graph data model to adapt it to their investigators’ needs.

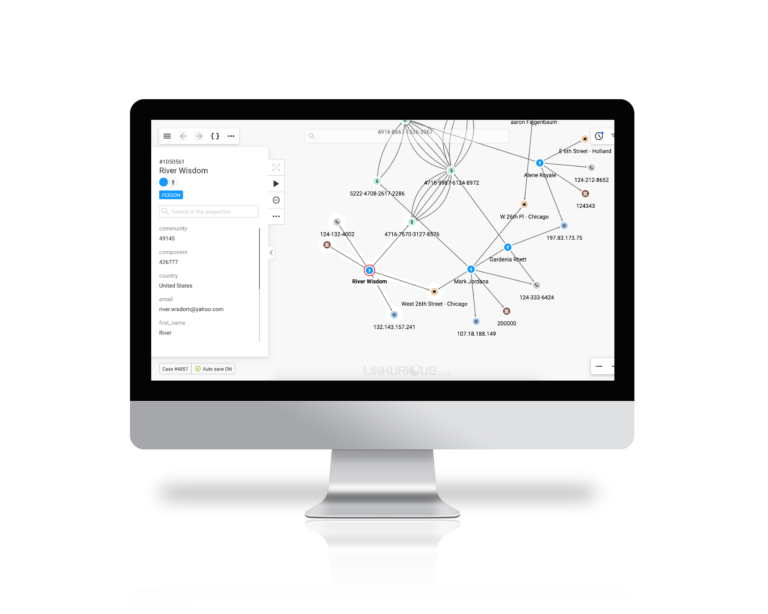

Natively designed to tap into the power of large-scale graph databases, Linkurious Enterprise gives its users a holistic view of the entities relevant to their investigations and their relationships. It’s a great match for teams of analysts and investigators who need to quickly gather information on networks related to fraud or money laundering. And the intuitive visual interface of Linkurious Enterprise makes it simple to find and understand even the most complex networks.

Investigating complex networks is precisely where Linkurious Enterprise has added value for Ria analysts. They’re using the software for post-transaction analysis of customers involved in suspicious activity and who have many connections. “The suspicious activity could be related to child exploitation, or terrorism financing,” says Miguel Aguado, Compliance Director Asia Pacific at Ria Money Transfer. “For more complex offenses, investigators need to see the scope of the network around the suspicious activity. When we need to get to the bottom of some business critical issue, then we use Linkurious Enterprise.”

Getting to the bottom of complex criminal schemes

An investigation at Ria can be triggered in a few different ways. The organization has several systems for detecting suspicious activities. They use a real-time monitoring system that puts a transaction on hold for investigation if it is deemed suspicious. They also have a rules-based, post-transaction alert system that can automatically generate alerts based on customer behavior. Finally, Ria also does analysis on big data to spot red flags, such as anomalies compared to corridor averages or transaction averages. This analysis can turn up individuals or groups that need to be investigated.

Sometimes cases are straightforward and involve simple transactions. Here, analysts can decide to take action immediately without needing to do an in-depth investigation. In other cases, an investigator understands the suspicious activity is part of a bigger issue. Linkurious Enterprise helps investigators get to the bottom of these cases. With its powerful graph visualization and exploration capabilities, Linkurious Enterprise lets investigators see the full scope of the network around a suspicious activity.

In a money laundering case, an investigator may be looking for predicate offenses linked to the flagged activity, which may involve many individuals and transactions.

In a case involving fraud, investigators can use Linkurious Enterprise to expand all their relevant data to identify accomplices and better protect Ria’s customers by preventing fraud before it happens. Using graph visualization, it’s also easy to understand who is the main actor in a fraud ring. This type of information is much more difficult to uncover using a table. “In a fraud case investigated using Linkurious Enterprise, the investigators were able to see the whole network based on an address. They couldn’t do that with our old system,” says Miguel Aguado.

Features that facilitate and accelerate investigations

Many of the built-in features of Linkurious Enterprise have helped the investigators at Ria accomplish their work more quickly and efficiently. “It was the only solution that checked all the boxes,” says Miguel Aguado.

Linkurious Enterprise has also helped Ria analysts simplify their visual data exploration. “When you’re working with a complex data model, it can be tough to explore the data.” Linkurious Enterprise provides filtering capabilities so investigators can focus on the relevant information to their case by filtering the nodes and edges according to category or property values.

Time is also an important factor for their analysis. Understanding how events and transactions occurred over a given period of time can be key to understanding the full scope of a case of fraud or money laundering. The Linkurious timeline feature has made it easy for investigators to quickly visualize when events have taken place.

Finally, powerful and flexible graph visualizations are a clear advantage for the investigative teams. “Visualization is an added value,” says Norma Otto Martinez, EU Consumer FIU Senior Manager at Ria, “Having the picture in front of you has a real impact.” She adds that analysts include visualizations in their reports. “Compliance officers can see for themselves the network you are detecting, and we have been told by regulators that they appreciate this.”

The result: faster investigations and regulator praise

By adding Linkurious Enterprise to their technology stack, analysts at Ria Money Transfer have significantly reduced investigation time by almost 80% in some cases. “I’m really pleased with this tool,” says Alejandro Rivas, analyst in the EU Consumer FIU team. “It helps us locate unusual activity really quickly. Analysis that would have taken us a full day may now take us 2 hours.”

Adopting Linkurious Enterprise has also fulfilled Ria’s initial objective to better meet regulatory expectations. When repeating investigations they did prior to adopting the software using Linkurious Enterprise, they are able to uncover more details and hidden connections than they could previously, eliminating blindspots. This means they can expose larger networks and more efficiently prevent sophisticated fraud and money laundering rings. The Dutch regulator complemented Ria’s new investigative set-up.

“Linkurious Enterprise shows you things you have no other way to find,” says Miguel Aguado. “We are able to identify patterns and ramifications of unusual transactions that were impossible to achieve with a traditional approach. With Linkurious you see things from another perspective—things you couldn’t see otherwise. You can do in three clicks what would take much longer otherwise.”

What’s next for Ria with Linkurious Enterprise?

Since first launching Linkurious Enterprise as part of their investigative solution in the Netherlands, Ria has expanded use of graph technology, which is now being generalized among their compliance teams globally. Analysts are now using it to get to the bottom of their complex investigations in Europe and APAC. And the number of analysts using Linkurious Enterprise is expanding, from several dozen today to up to 100 globally.

Ria is exploring ways to expand the use of the tool, such as using it to respond to law enforcement subpoenas. They are also moving towards graph technology being a central component in their work. “My objective is for this to be used as a core part of the analysis,” says Miguel Aguado.

They plan to begin using alerts directly within Linkurious Enterprise for increased control and flexibility, since their current rules-based alerts system is costly and cumbersome to customize. “With knowledge of Cypher query language, we can easily adapt our queries,” says Miguel Aguado. “You don’t need to be an expert in programming to do this.”

Finally, Ria is working on integrating other technology layers like machine learning with graph and the rest of their tech stack—an especially promising technology for difficult to spot illicit activity like terrorist financing. “Internally we have a team working on this. It’s not something easy that can be done overnight, but they are promising very good results.”

A spotlight on graph technology directly in your inbox.