Insurance fraud detection and investigation using Linkurious Enterprise

In the US alone, insurance fraud costs companies more than $40 billion per year, according to estimates by the FBI. Fast, effective insurance fraud detection capabilities are critical for insurance companies up against organized groups of fraudsters.

Yet, the insurance fraud detection and investigation processes remain present challenges for these organizations. Many of them simply lack the appropriate tools to detect and investigate complex fraud schemes hidden in large volumes of data.

Next-generation detection and investigation software can help insurers expose fraudulent activities within large volumes of data. In this article, we take a look at property damage claims and show how to detect suspicious patterns and investigate insurance fraud cases with a solution built on graph analytics like Linkurious Enterprise.

Insurance fraud schemes

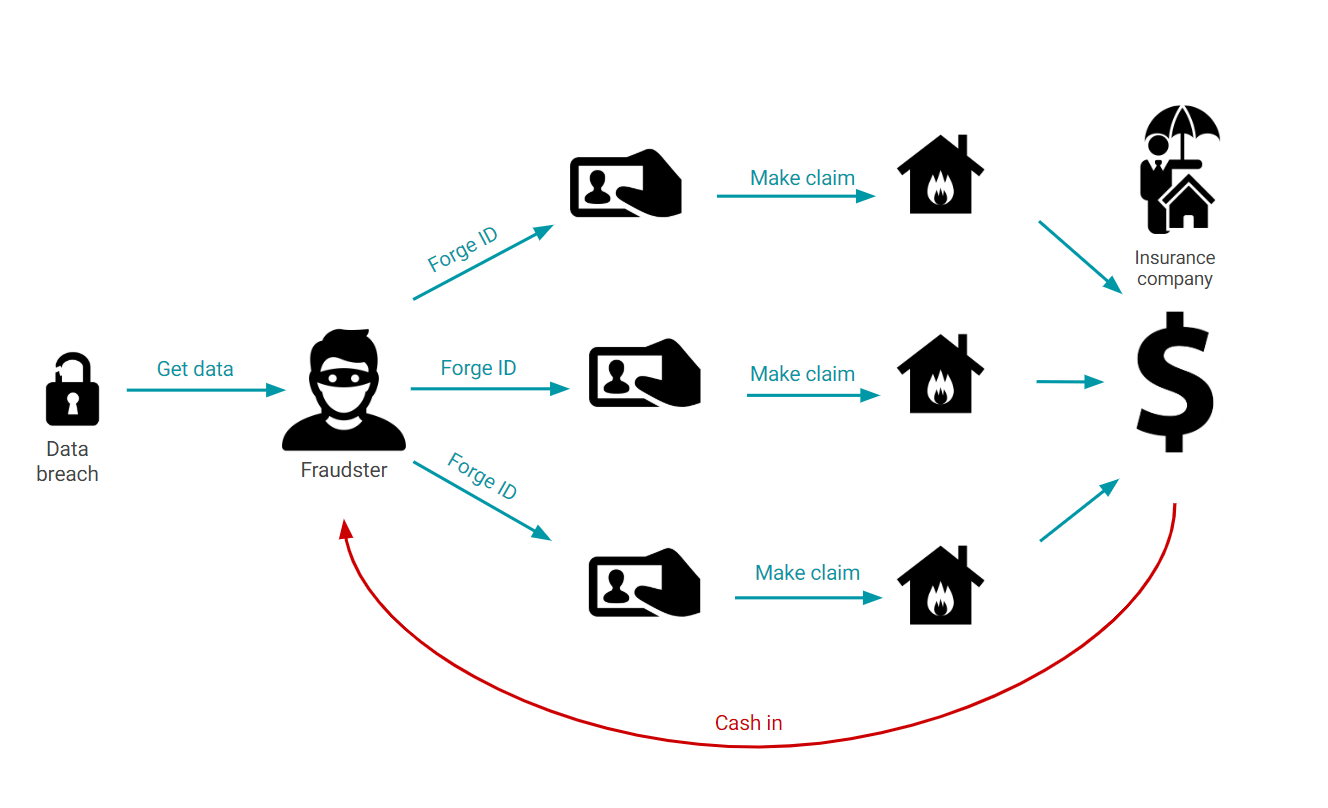

Insurance fraud is rarely the work of an isolated individual. This type of fraud is commonly the work of organized crime groups or other complex networks that are difficult for insurance and financial institutions to detect. One of the most common techniques used by fraudsters is the following:

- forge fake or synthetic identities,

- file several claims,

- and cash the insurance checks.

Creating fake identities requires fraudsters to forge or usurp personal information (social security numbers, addresses, credit cards, etc), to submit to insurance companies to become a customer. Forging new information for each fake identity they create comes at a high cost for fraudsters. This is why fraudsters often recycle this data to create several fake identities.

Insurance fraud detection using graph analytics

Typically, insurance companies rely on relational databases (RDBMS) to store their customer data. Those systems, designed in the ’80s to codify paper forms, store data in tabular structures.

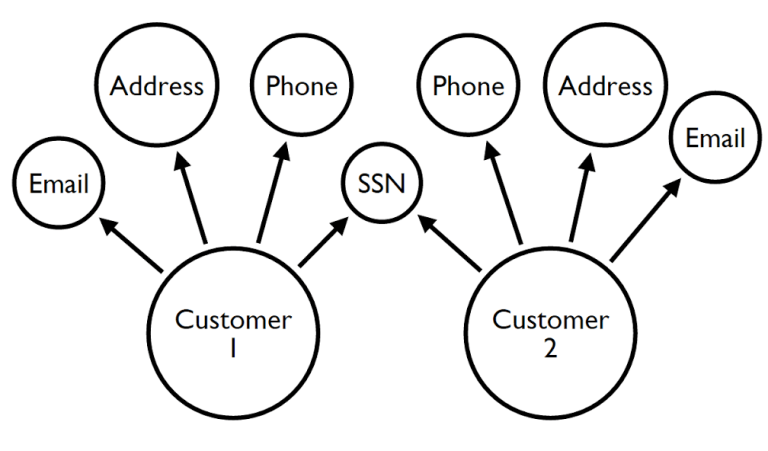

But rather than considering it as tables of information, we can consider the data collected by insurance companies as a graph. In a graph, each piece of information (SSN, address, profession, claims) is a node, and each node is connected to others through edges, which store information on relationships.

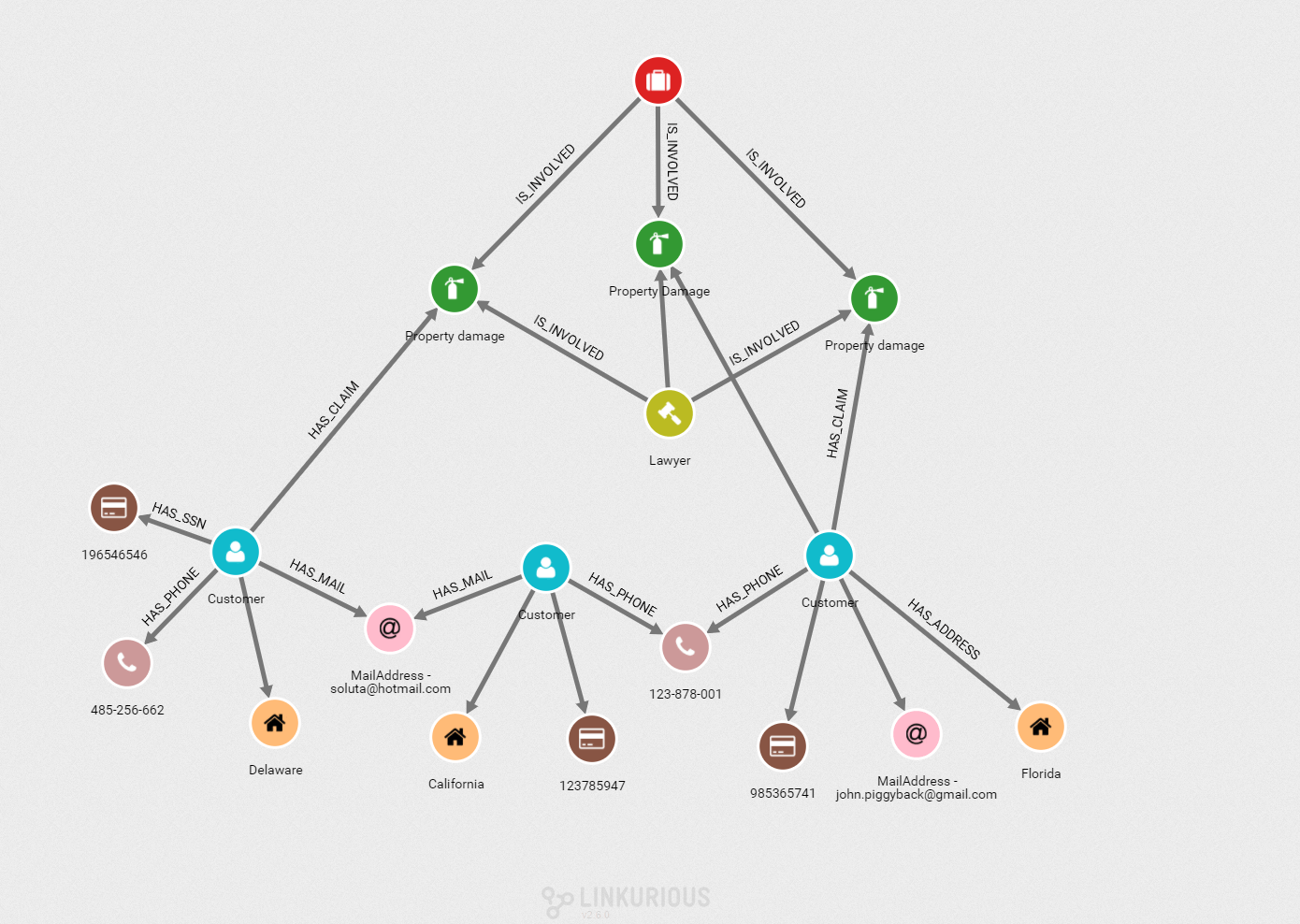

Insurance data is, by nature, connected. For example: “Customer A is connected to address A and customer B is married to customer A.” And detecting fraud is often about spotting connections that should not exist: “Customer A is connected to the same SSN as customer B.” By adding the “connection” dimension into the data with graphs, it becomes easier to spot suspicious insurance fraud patterns in large datasets.

The picture above shows two customers and their connections. Each customer has a unique personal address, phone number, and email but somehow they share the same SSN, which is normally unique for each individual.

Limits in current insurance fraud investigation tools

Almost all fraud detection and investigation tools are backed by the relational database systems mentioned above. RDBMS remain one of the best tools for storing and organizing data.

Yet, when it comes to querying and visualizing large amounts of connected data, RDBMS do not perform well and often lack important features:

- they are slow,

- they are not flexible in terms of modelization,

- they are unable to query the data in real time.

Anti-fraud tools are hampered by these limitations. And all these issues make them difficult to use for fraud, where analysts need to identify and investigate suspicious connections quickly. Graph analytics makes it possible to overcome these limitations, simplifying the job of fraud analysts.

Investigating suspicious looking patterns in data with a tool like Linkurious Enterprise is fast for analysts and can be automated. Without previous knowledge of graph analysis, teams can carry out complex investigations to detect insurance fraud cases.

Visualizing insurance fraud schemes

A graph visualization and analytics tool provides a user-friendly interface to visualize and interact with graph data. Analysts visualize networks of data, making it easy to understand how different entities are connected. This offers several advantages, among which: faster comprehension of data and higher chances of discovering even highly complex fraud cases.

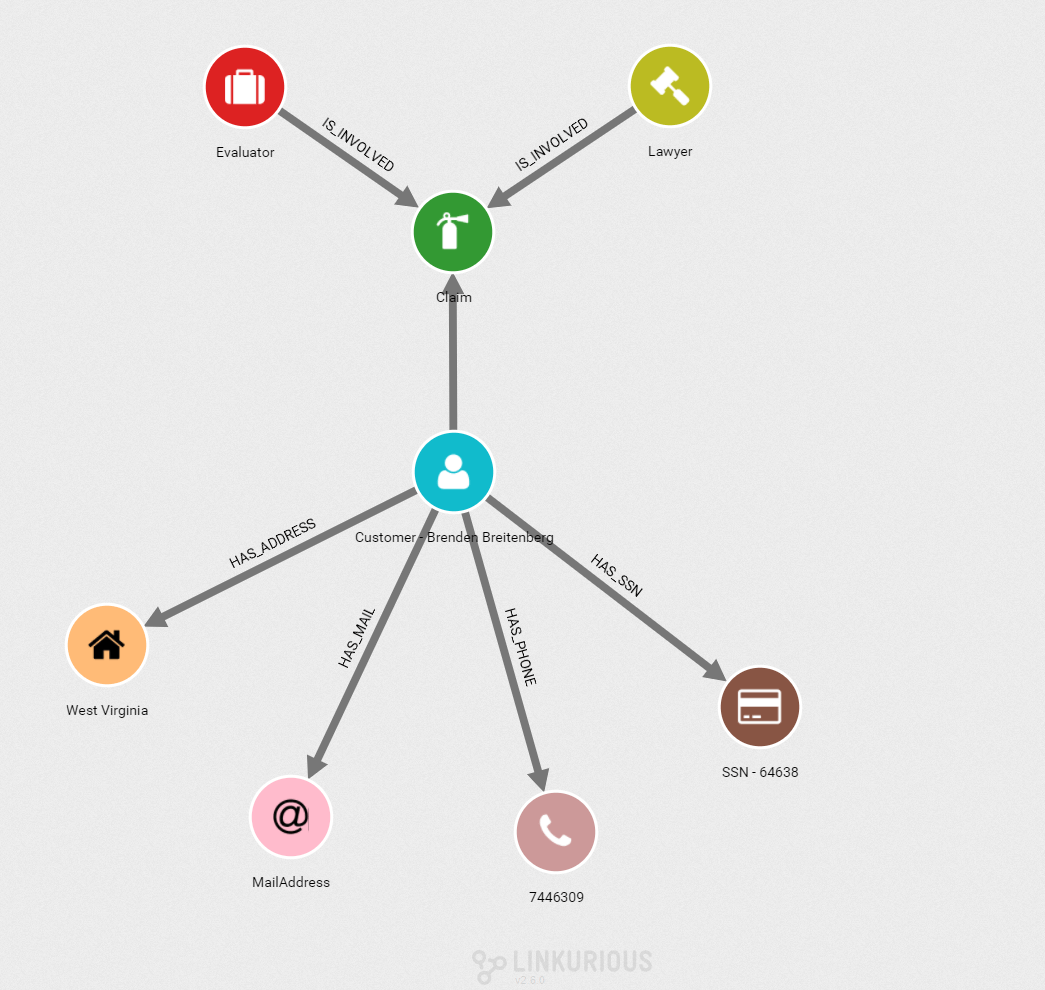

Here is what a “normal” insurance customer looks like. The customer is connected to a claim, a social security number, a phone number, an email address, and an address. We can see that he doesn’t share any of his personal details with other existing customers or known fraudsters. A lawyer and an evaluator are connected to the claim.

At a glance, it’s possible to understand that 8 different entities are connected and assess that the situation seems normal. As an analyst, this picture can be used as a “template” that will make identifying fraud cases easier.

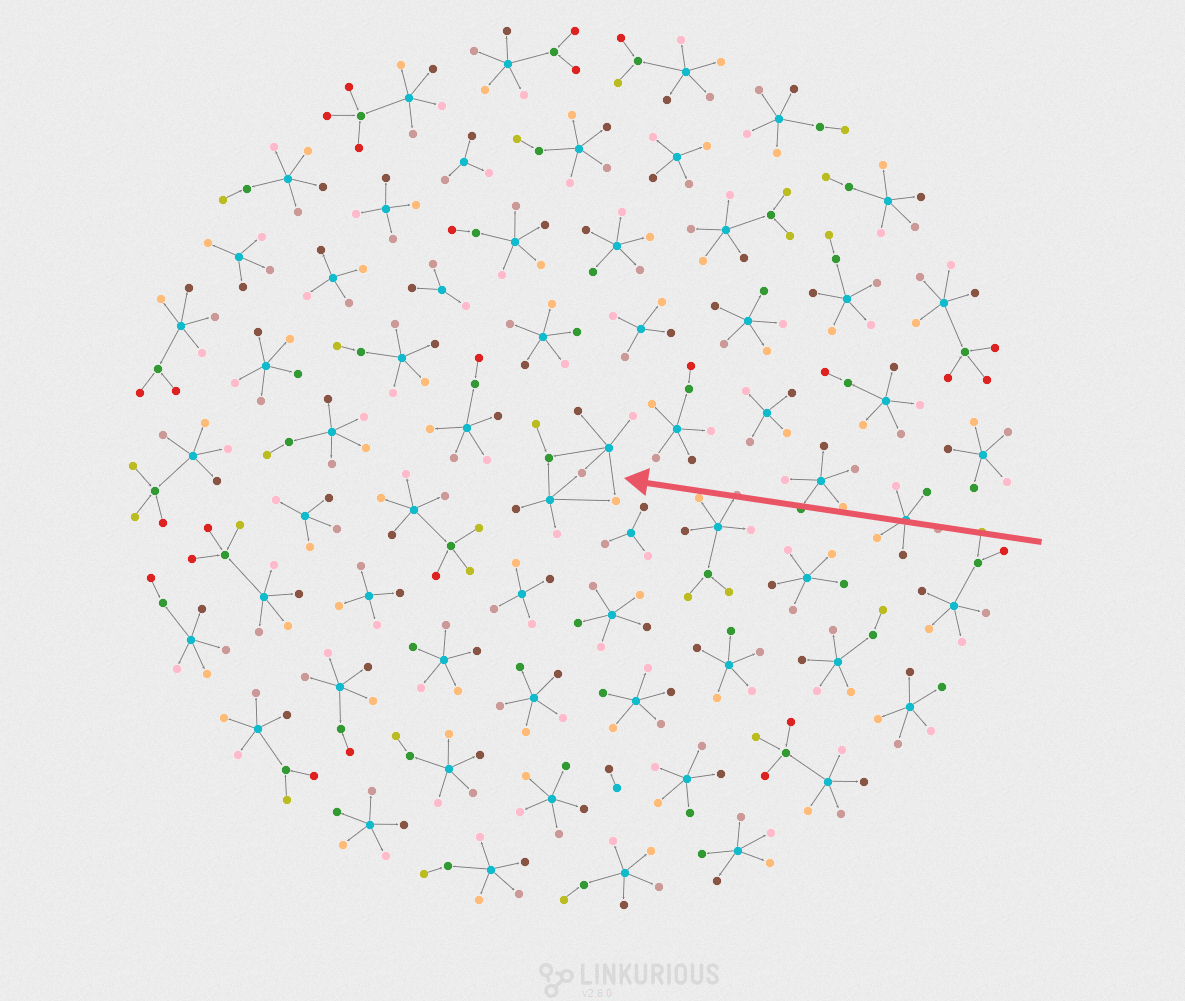

The human brain identifies pattern variations faster through a visual display so, even with larger volumes of data, we easily spot patterns differences. This situation should thus directly attract the attention of a skilled analyst that can immediately take a closer look.

Automate the detection of suspicious patterns

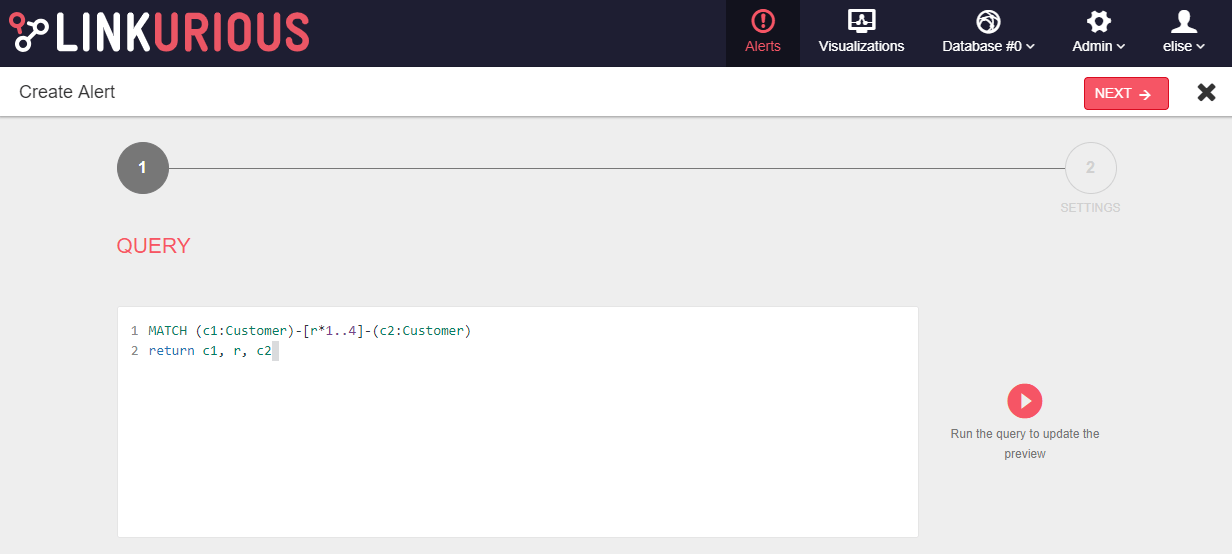

Detection systems backed by relational technology will be able to trigger alerts based on tabular rules and thresholds. This is a first step, but it is not enough in the face of complex fraud schemes. With Linkurious Enterprise alert management system, you can automate the detection of numerous real-life fraud patterns, such as a ring of several fraudsters using layers of fake identities to make claims. Graph query languages such as Cypher or Gremlin serve as a basis for describing complex scenarios. Linkurious Enterprise then reports all the occurrences of that scenario for analysts to assess.

In this very simple example, the system will search for scenarios where customers are sharing common personal information.

Analysts get a list of occurrences of that scenario in the data in real-time, ready for review. Linkurious Enterprise has a variety of styling, captioning and filtering capabilities to improve the reading of graph data so analysts understand the situation in the blink of an eye.

If we take the first example, we understand quickly that two customers sharing an address also have the same last name. We are probably looking at a couple. The situation is normal. The investigator can choose to dismiss the case or open a low priority investigation.

Linkurious Enterprise helps save precious resources, and avoid customer dissatisfaction.

Analysts will spot fraudulent situations as quickly as they assess potential false positives.

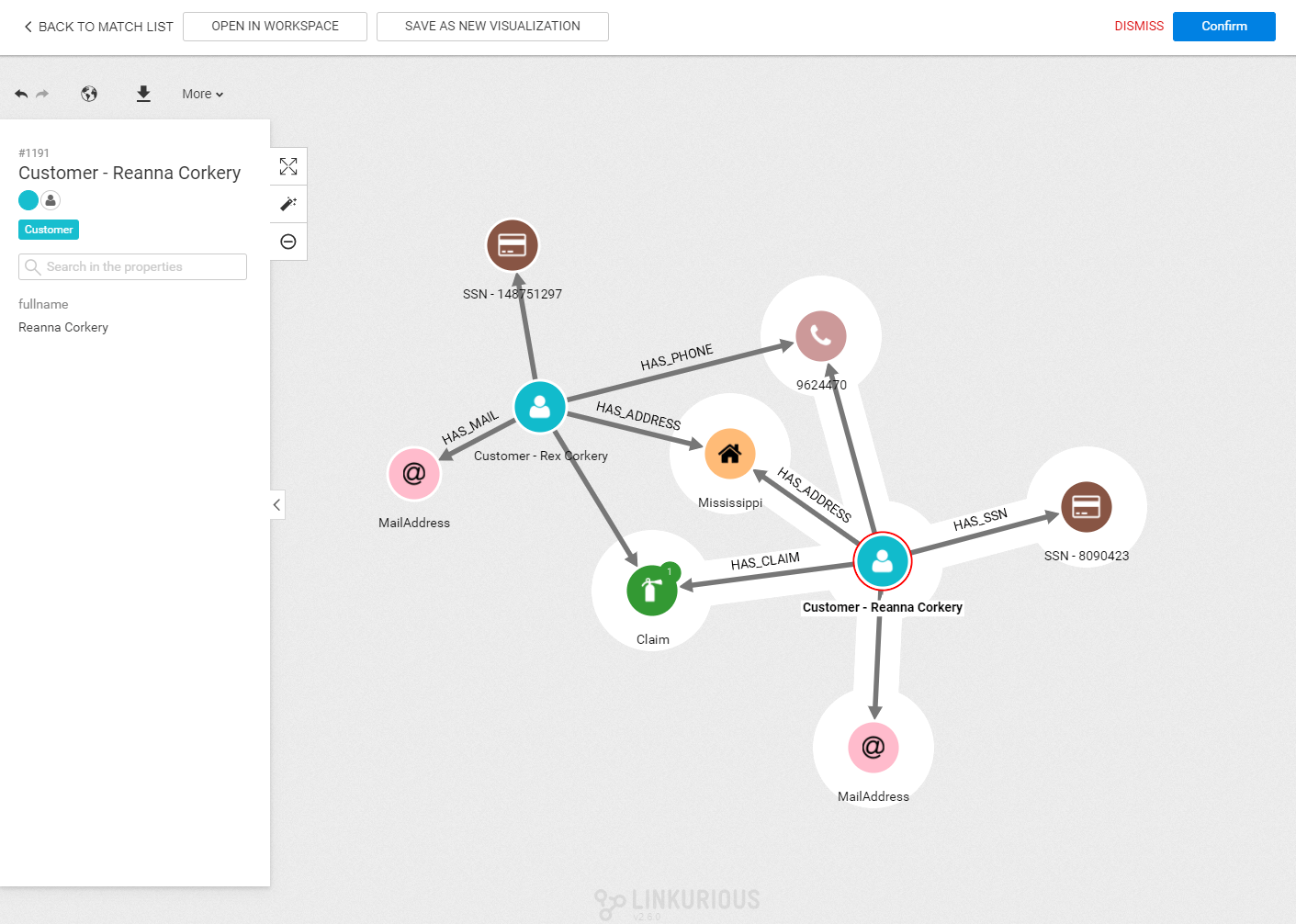

In this new match from the alert, let’s look at three new customers and the property damage claims they are connected to.

These claims are under the supervision of the same lawyer and the same evaluator. Curiously the two customers that instigated the three property damage claims, John Piggyback and Werner Stiedemann, are both linked to a third existing customer, Paula Smith. Piggyback has the same phone number and Stiedemann the same email address as her. This is an abnormal situation as neither of the two share her name or address.

This situation is very likely to be insurance fraud. The fraud investigators can export its findings from Linkurious Enterprise to fill in a report to block the transactions for all three cases, or share the visualization with a colleague to further the investigations.

Linkurious Enterprise brings the power of graph to fraud analysts through an intuitive investigation interface. They leverage alerts to detect and assess real-life data scenarios of fraud situations quicker than ever. Analysts focus on the visual investigation of the most complex cases to prevent damages and preserve the customer experience. With Linkurious Enterprise, they collaborate to dismantle entire fraud networks at once and share intelligible reports to authorities.

A spotlight on graph technology directly in your inbox.